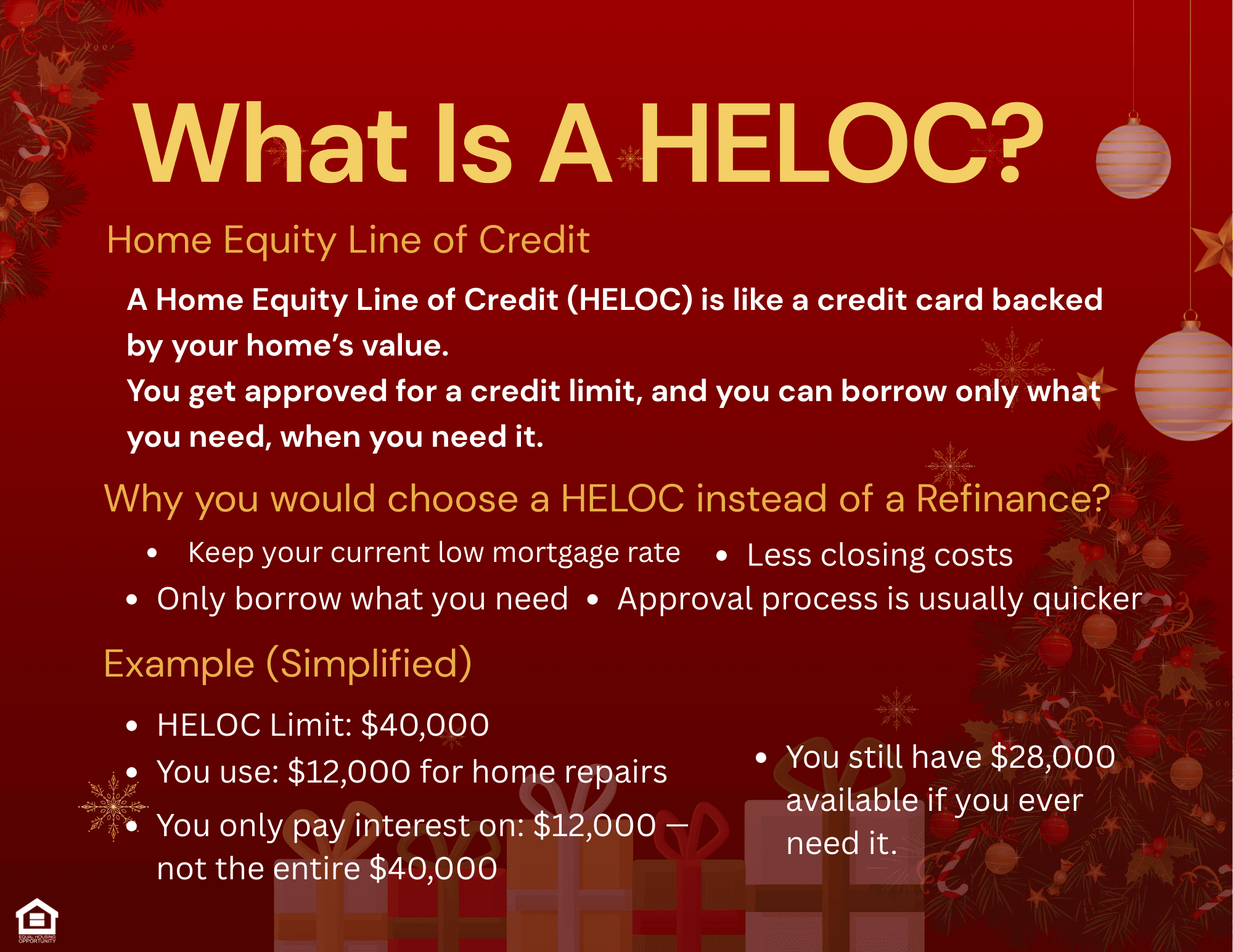

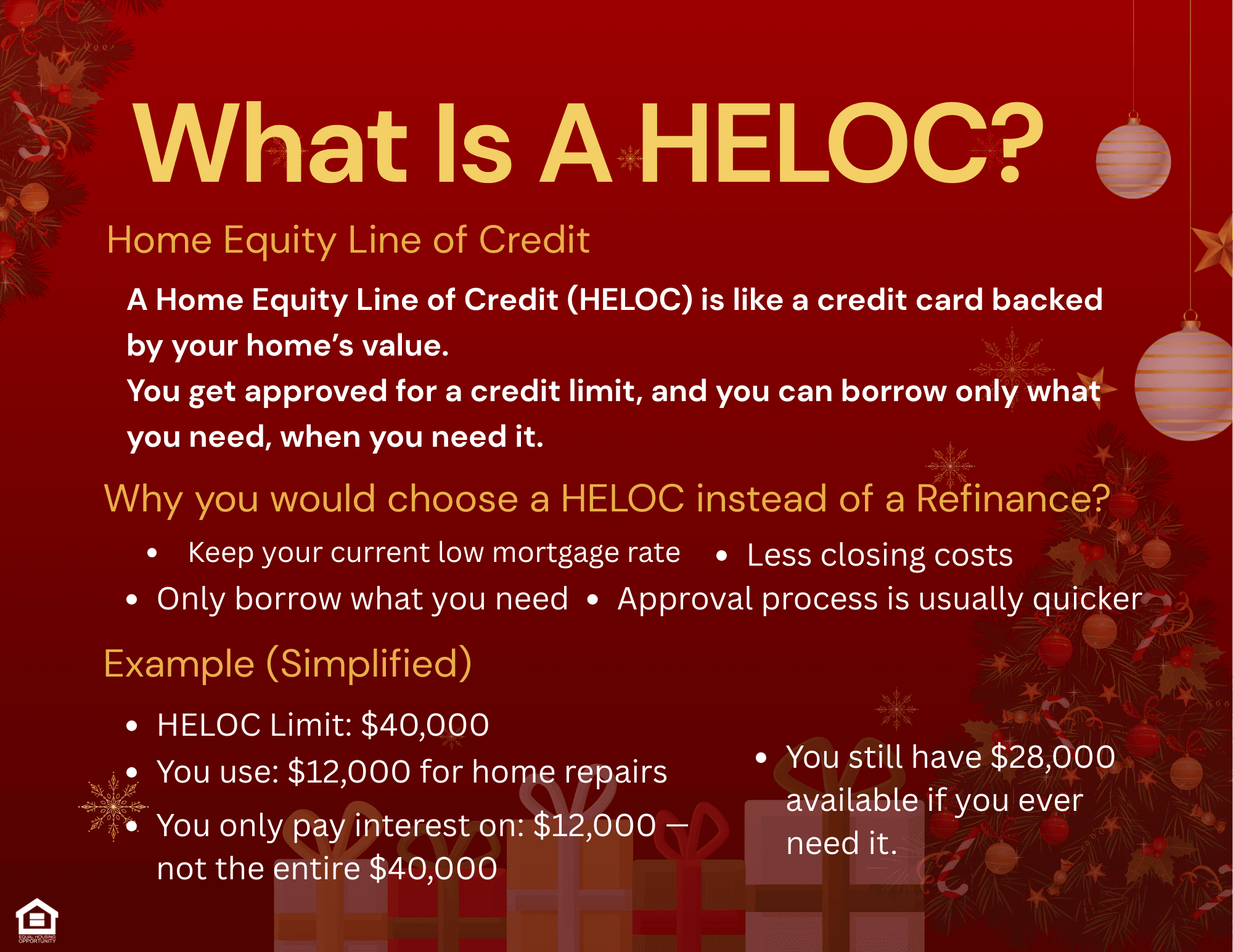

Getting ready for holiday spending, home upgrades, debt consolidation, or year-end bills?

A Home Equity Line of Credit (HELOC) through MKG Enterprises Corp (TPO) lets qualified homeowners tap available equity as a flexible line of credit—without replacing their first mortgage.

Why homeowners like HELOCs

- Keep your current low mortgage rate on the 1st lien

- Borrow only what you need, when you need it

- Typically lower costs than a full refinance

- Interest is generally charged only on what you use

Example: Approved for a $40,000 HELOC and you only draw $12,000 for repairs—you generally pay interest on $12,000, while keeping $28,000 available for later use.

Program highlights (Standalone vs. Piggyback)

Standalone HELOC (access cash with a separate line)

Popular for debt consolidation, home improvements, and life events.

- Up to 85% LTV (subject to qualifications)

- Primary & second homes

- 20-year term

- Line amounts up to $350,000

- Minimum 660 FICO

- Minimum credit line: $25,000

- Initial draw requirement may apply (often 75% of the line)

- Valuation:

- Up to $250,000 line: approved AVM may be acceptable

- Over $250,000 line: full appraisal required

Piggyback HELOC (open a line with a new first mortgage)

A strategy for qualified conventional borrowers who want to split the first/second—often to reduce or avoid mortgage insurance or keep the first within conforming limits.

- Primary & second home: purchase, rate/term, and cash-out refi (conventional eligibility applies)

- Line amounts up to $350,000

- Minimum 680 FICO

- Minimum line: $10,000

- Initial draw requirement may apply (often 75% of the line)

- Valuation: AVM/appraisal waiver may be accepted up to $250,000 with an approved AVM; over $250,000 requires full appraisal

- Not available in Texas

Check your options / Apply 24/7

Shop home equity options online

Easy & secure online application

Disclosure: Not a commitment to lend. All loans are subject to credit approval, income/asset verification, title review, and acceptable property valuation (AVM/appraisal). Program guidelines, rates, and terms are subject to change without notice. Consult your tax advisor regarding potential tax implications. MKG Enterprises Corp — Equal Housing Lender. NMLS #1370394.