Unlock new selling potential for high-balance properties. MKG Enterprises Corp provides second-mortgage servicing solutions that preserve affordability and expand financing beyond traditional limits.

“Empower Sellers. Elevate Buyers. Expand Possibility.”

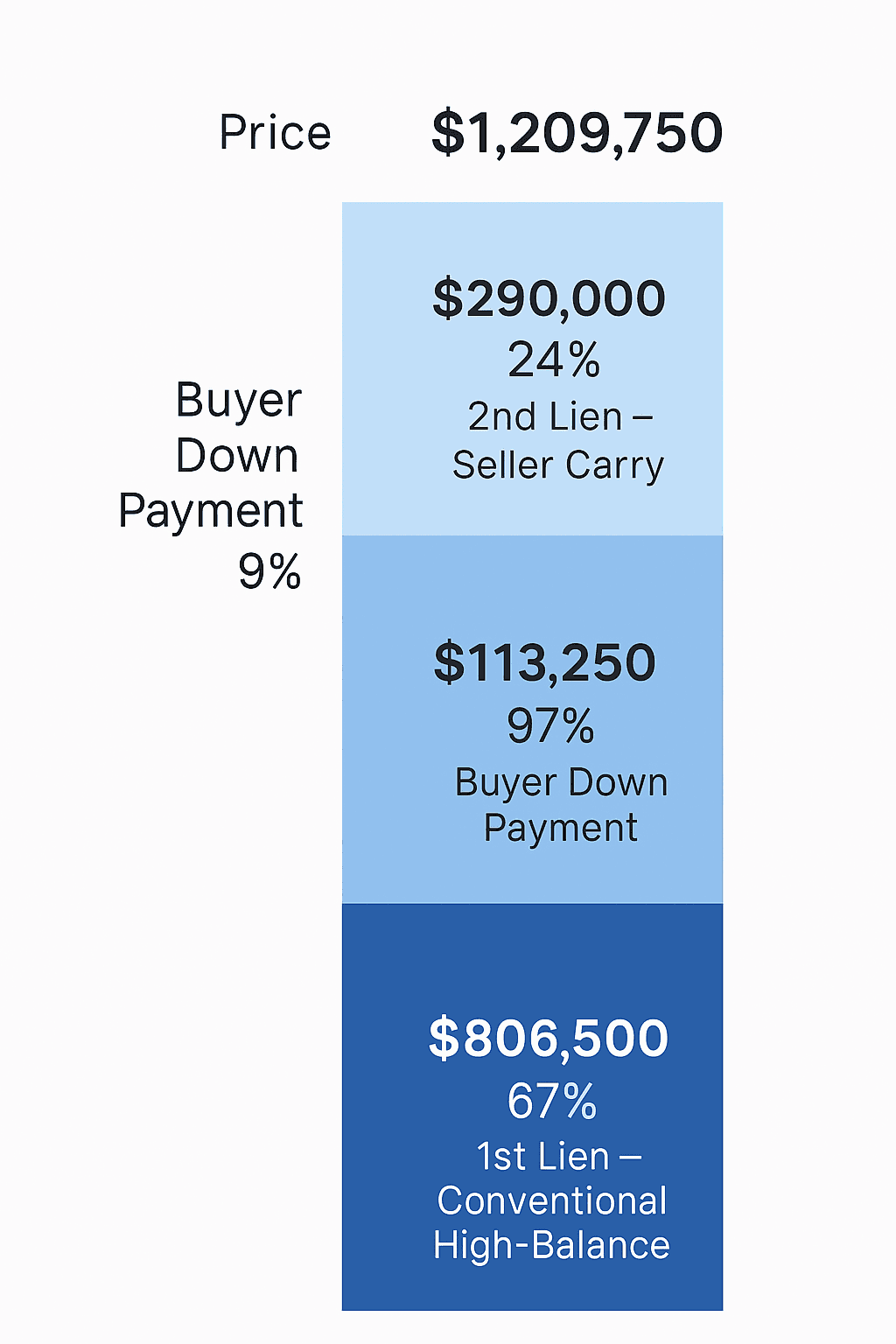

MKG Enterprises Corp offers a Conventional Loan Program with a Blended Second Mortgage designed for homes priced between $806,500, $1,000,000 and up to $1,209,750, depending on seller/buyer county where traditional conforming loan limits no longer cover the full purchase price.

This innovative structure allows qualified buyers to combine a conforming first mortgage (up to $806,500) with a blended second mortgage serviced by MKG Enterprises Corp, helping bridge the gap for higher-value homes — without exceeding a 95% combined loan-to-value (CLTV).

Buyers can now finance homes above the conforming limit while keeping monthly payments manageable and maintaining equity growth potential.

🔗 www.mkgenterprisescorp.com/book-an-appointment

✅ Combined financing for properties priced $806,500–$1,209,750

✅ 95% CLTV maximum for enhanced affordability

✅ Single blended structure with coordinated payment servicing

✅ Second mortgage serviced exclusively by MKG Enterprises Corp

✅ Streamlined process with fast approvals and personalized options

MKG Enterprises Corp is a licensed mortgage lender and Equal Housing Lender. NMLS ID # 1370394 and not affiliated with or endorsed by Fannie Mae, Freddie Mac, or any government agency. All loans are subject to credit approval, underwriting, and property appraisal requirements.

Sell homes priced from $806,501 to $1,209,750 with MKG Enterprises Corp’s blended second-mortgage financing. Bridge the gap between conforming loan limits and successful home sales.

This innovative structure allows qualified buyers to combine a conforming first mortgage (up to $806,500) with a blended second mortgage serviced by MKG Enterprises Corp, helping bridge the gap for higher-value homes — without exceeding a 95% combined loan-to-value (CLTV).

Buyers can now finance homes above the conforming limit while keeping monthly payments manageable and maintaining equity growth potential.